Environment

Global Natural Gas Issues:

a Canadian Regulator's Perspective

Presented by

Ken Vollman

Chairman

National Energy Board

World Forum on Energy Regulation

Washington, DC

10 October 2006

Global Natural Gas Issues

My contribution to today's panel discussion on natural gas issues will be to provide a Canadian regulator's point of view.

Keeping in mind the theme of the session I shall attempt to do this in a continental and global context.

- Presentation outline

- Canada is world's 3rd largest natural gas producer

- Role of Canadian gas in continental supply

- Canadian natural gas supply

- Oil sands natural gas requirements

- Natural gas for power: U.S. generating capacity additions

- Natural gas for power generation

- Natural gas for power generation: the implications

- LNG re-gasification capacity

- Implications of increased LNG supply

- Major flow patterns from supply basins to markets

- Changes in supply and demand, 2006 vs. 2004

- How to fill "the Gap" by 2020

- A potential scenario for filling "the Gap"

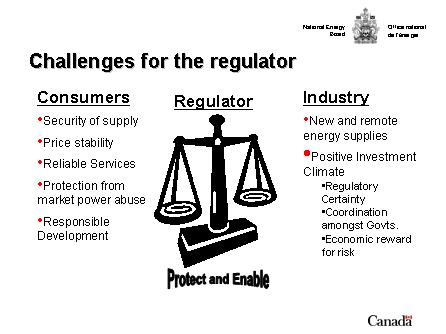

- Challenges for the regulator

Presentation outline

After highlighting the Canadian natural gas picture, I will talk about five key issues.

I've prepared a couple of slides to provide context for each of the issues listed in this outline. To explore each fully would certainly take more than 10 minutes. So I'll be focusing on the points I want to emphasize and would be pleased to return to any other matters the slides raise during our discussion period at the end.

Canada is world's 3rd largest natural gas producer

With respect to the Canadian picture, the first point I want to make is that Canada, shown here as the red bar, is the world's third largest producer of natural gas, exceeded only by Russia and the USA.

Role of Canadian gas in continental supply (Bcfd)

The next part of the picture is the role Canadian natural gas plays in continental supply.

Canadian production, is shown as the red bar on this graph, U.S. production is in blue and Mexican production in green.

Canadian production has and will continue to play a big role on this continent.

Canada currently supplies ¼ of North American gas demand.

Canadian natural gas supply

That invites the question of what role Canada will play on a go forward basis.

This slide represents some work we have in progress on the outlook for Canadian natural gas production. I want to use it to make two points:

- you will note that from the mid-80s to the turn of the century, production increased by 10 Bcfd. This growth satisfied 75 percent of incremental U.S. gas demand over that time frame;

- the second point concerns the outlook for gas supply. There probably exists some misunderstanding about possible future production levels in Canada. Our studies suggest that the most probable outlook is for production to remain flat at the current level of some 17 Bcfd.

Canada has large resources of non-conventional supplies including CBM, tight gas, and frontier gas. A number of sites are also being studied for LNG import terminals. The pace of development will depend on a number of factors including the need for large investment in infrastructure, technological advancements and a favourable investment and regulatory environment.

Note: this is a scenario developed by Board staff in consultation with a variety of stakeholders. It is not a Board forecast.

Oil sands natural gas requirements

The first issue I want to highlight is the growing use of natural gas within Alberta to extract oil from the oil sands.

Canada has enormous deposits of bitumen in vast oil sands deposits in Alberta. The Alberta regulator has estimated that over 300 billion barrels of oil could be recovered. Huge amounts of heat are required to unlock this resource and natural gas is currently the fuel of choice.

Bottom line is that we expect requirements for natural gas could triple in the next ten years and to increase more in the future.

So while gas production is likely to be flat, the amount of natural gas leaving the province of Alberta will be reduced somewhat by intra-basin demand growth.

Industry is examining fundamental changes in the recovery and upgrading processes, which could moderate growth in usage in the future.

Natural gas for power: U.S. generating capacity additions

The second issue I want to discuss is the growing use of natural gas for power generation in North America.

Shown here is the generating capacity added in the U.S. since 1990. Natural gas fuelled capacity is shown here in red - and all other fuel sources in yellow.

In both Canada and the U.S., almost all recent increases in generating capacity have come from gas-fired facilities. Indeed, over 160 000 MW of gas-fired generation has been added since 2000.

These were built on the premise that natural gas was plentiful in North America and that the prices for natural gas would be relatively inexpensive.

The gas and power businesses are now more closely linked than at any time in the past. While the pace of the increase has slowed recently, there is still a "dash to gas" mentality around.

In general, neither of the premises have panned out as expected, with supply being relatively tight and costs being fairly high in comparison to the past.

Natural gas for power generation

I invite you to study this graph later - the sole point I want to make now is that during winter (look at the red ovals), gas for power is challenged by needs of gas for other requirements (for example, residential/commercial space heating).

This raises questions about the extent to which we should count on gas-fired electricity during winter peak demands.

Natural gas for power generation: the implications

There are a number of other implications for the increased use of natural gas for power generation.

I've listed some of the more important ones on this slide.

They include increased price volatility and the need for regulators to show more flexibility in their processes to serve the changing needs of suppliers and customers. Such things as location specific pricing, or location specific flexibility may be required.

LNG re-gasification capacity

The third issue I want to touch on is the inevitability of increased imports of LNG into North America.

You've likely seen graphs like this that show the imagination of the market in developing potential projects.

By using proportional arrows I've tried to depict: i) where the market is finding opportunities, and ii) that in total they add up to ten times the current installed re-gasification capacity.

Implications of increased LNG supply

We have very limited experience in Canada with LNG, so I am very much looking forward to learning from others at this conference.

Some implications however seem pretty obvious and I've shown a few here.

Price volatility, the need for infrastructure, and gas becoming a global commodity are worth noting.

Major flow patterns from supply basins to markets

The fourth issue in my presentation is the changing flow patterns of natural gas in North America.

North American gas supply comes from four major supply regions.

More than half of North American demand is geographically distant from the sources of supply.

Hence the importance of the many major pipelines which traverse the continent.

These patterns change with time, requiring continuous changes to the pipeline infrastructure.

Changes in supply and demand,

2006 vs. 2004 (Bcfd)

I've included this slide simply to show how much the basin fundamentals have changed in just two years. Imagine the magnitude of infrastructure changes we should be prepared for if we're looking out 10 or 20 years.

Changes in infrastructure often involve two or more countries. Consequently, it is important that we maintain and enhance the institutional arrangements we have for coordination between FERC and the NEB, or between FERC and CRE.

How to fill "the Gap" by 2020

My last issue involves speculating about the future to see what sort of changes we should be preparing for as regulators.

Based on a number of forecasts, it's not unreasonable to assume that North American gas demand could grow by 16 Bcfd by 2020. Supply from traditional sources is not expected to grow by more than 2 Bcfd. So we're potentially looking at a "gap" of some 14 Bcfd.

Of course there will not actually be a gap. But how will it be filled?

The purpose of this exercise is to check whether we, as regulators, are ready to deal with the various proposals. How will we handle competing proposals? Are the rules ready and recognizable? Are the rules consistent and fair for all comers? How much should the regulator be involved in the policy sector?

A potential scenario for filling "the Gap"

The red bars on the left represent the growth expected in North American gas demand. Of more interest are the blue bars on the right which represent a way of filling the gap. Forecasters are typically relying on Alaska gas (the fourth blue bar) and LNG (the fifth blue bar) as primary elements of the solution.

You might not share these views but hopefully this is a good starting point for asking ourselves some questions.

- What will be the effects of a huge step entry of Alaska gas into the market - and can it compete with smaller re-gasification terminals - if yes, when will it start?

- Should North America be concerned by rapidly growing LNG imports, coming in some measure from less stable sources around the world?

- Can we accelerate development of the technology required to develop the non-conventional sources shown at the right of the graph?

- To what extent can conservation reduce the gap?

Challenges for the regulator

The issues I've discussed, and their implications, pose some interesting challenges for regulators. I'm going to conclude my remarks with four challenges. The four challenges for the regulator include balancing:

- The consumer's need for price stability vs. the likely reality of even increased

price volatility going forward.

(solution elements: public education, contract choices) - The need for security of supply vs. increased reliance on potentially riskier

supplies and a 'lumpy' investment profile.

(solution elements: positive investment climate) - Delivering regulatory certainty in the face of growing complexity with the evolution

of a global gas market?

(solution elements: regulatory capacity, partnership) - Maintaining regulatory independence while sharing information and advice with policy makers.

(solution elements: provide factual information, yes there is a role)

Finally, I continue to believe that regulators have a duel role to both protect and enable which to me means to regulate in a way that seeks to protect against the negative impacts of energy development while enabling desirable outcomes. It may be that as the current issues impact consumers, the enabling role will take on more importance in the public eye.

| Updated: 2006-10-20 | Important Notices | |